Abu Dhabi’s Mubadala Investment Company and U.S.-based Fortress Investment Group have entered into a strategic partnership to invest $1 billion across private credit, asset-based lending, and real estate opportunities globally.

The investment, to be deployed through Mubadala Capital — the asset management arm of Mubadala — will be directed toward Fortress’s existing credit strategies, targeting sectors such as middle-market lending, distressed debt, and real estate finance. This initiative builds on Mubadala Capital’s recent acquisition of a 68% stake in Fortress, finalized in May 2024, while Fortress's management retains a 32% share and continues to lead daily operations.

The partnership reflects the growing global appetite for private credit as regulatory pressures and economic volatility limit traditional bank lending.

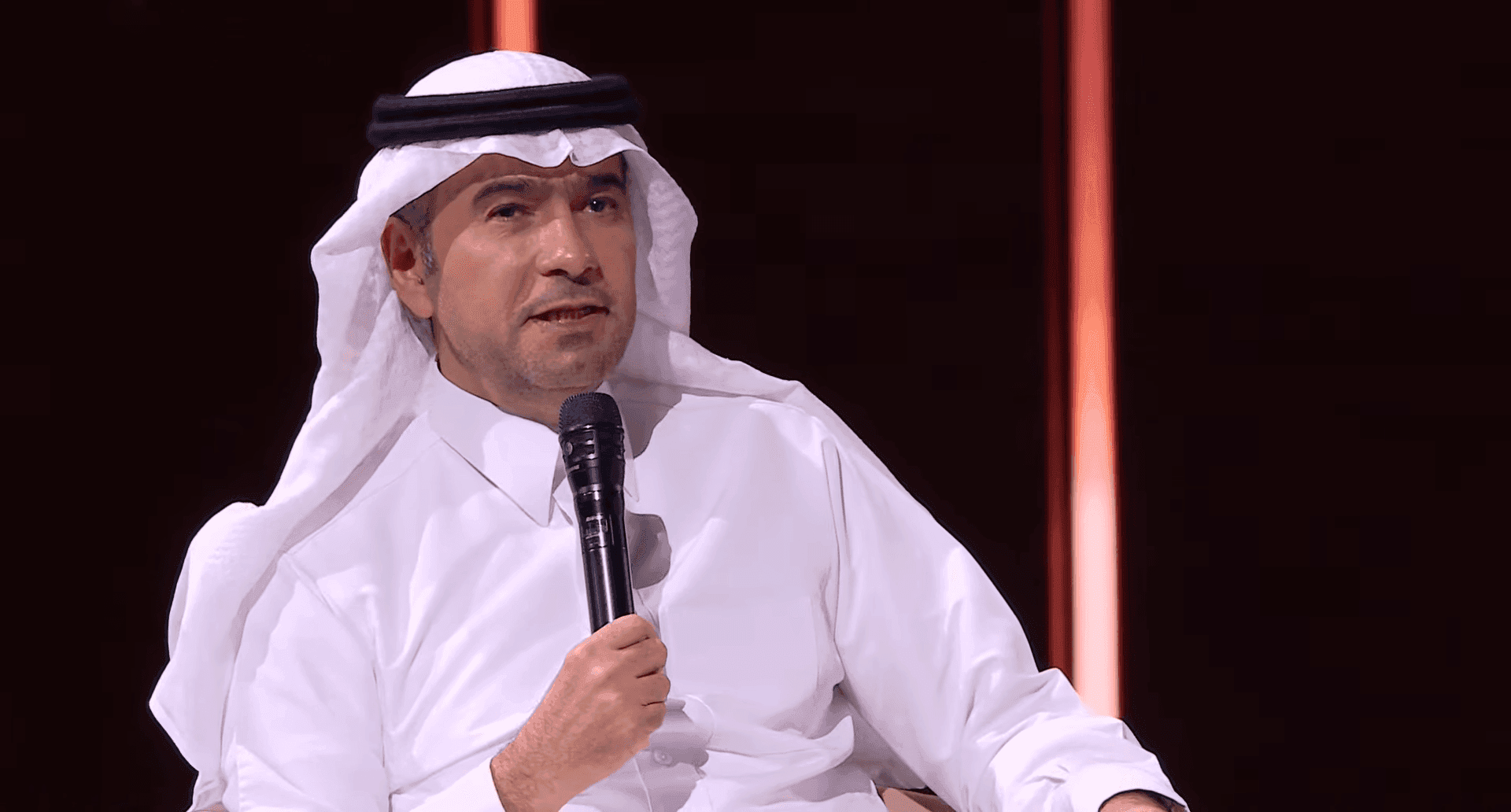

Omar Eraiqaat, Deputy CEO of Credit Investments at Mubadala, emphasized the importance of the new initiative:

"Private credit continues to play an increasingly vital role in global capital markets. This partnership represents a unique opportunity to invest alongside one of the industry's most experienced teams to deliver attractive, risk-adjusted returns for our investors."