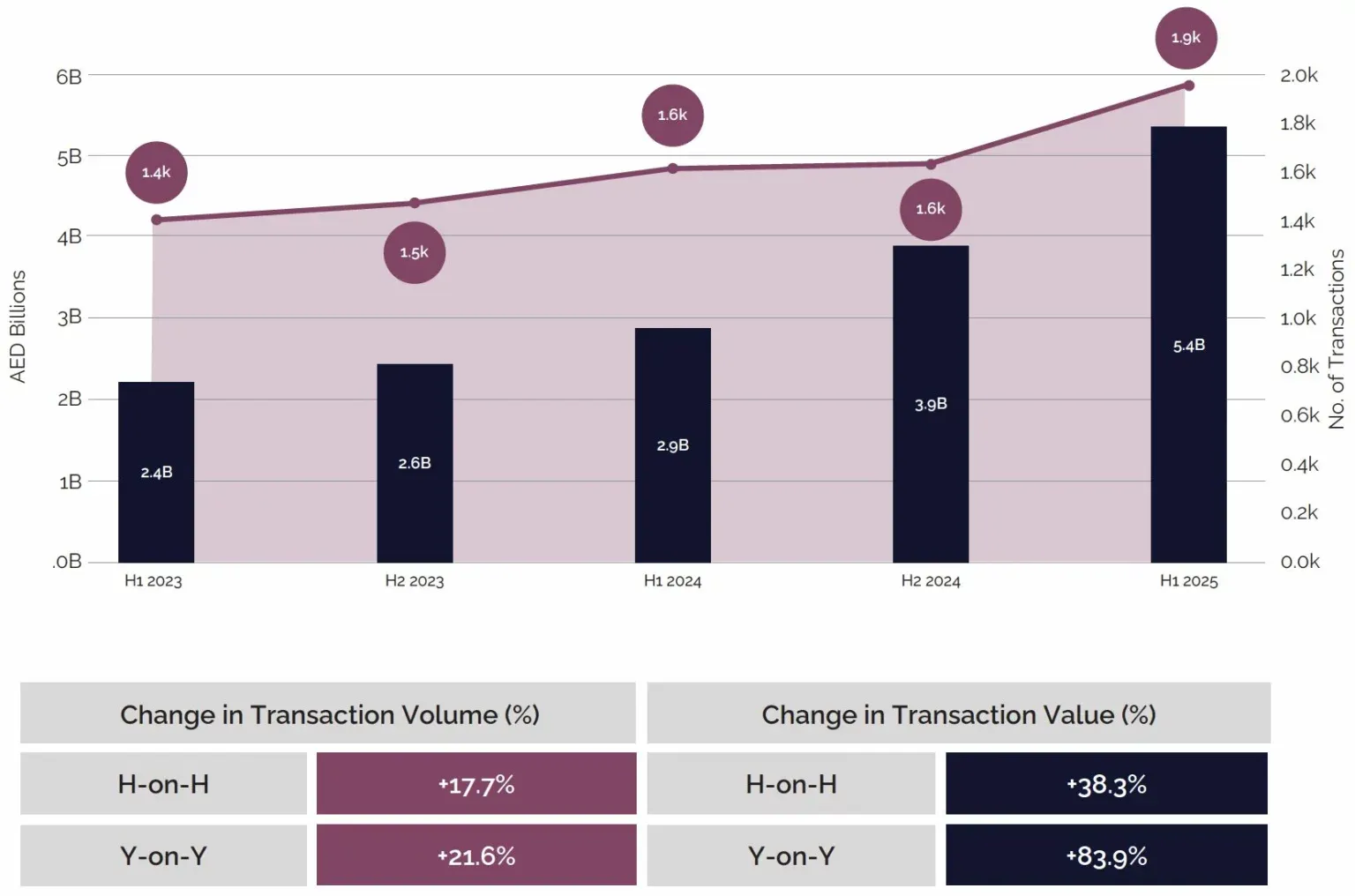

Dubai, UAE – August 14, 2025 –Dubai’s office market has recorded a sharp 84% year-on-year increase in sales values, reaching $1.47 billion (AED5.4 billion) across 1,900 transactions, according to new analysis from leading real estate advisory Cavendish Maxwell.

The number of transactions rose 22% compared to the same period last year, reflecting unprecedented demand for commercial space, especially in the prime office and logistics sectors, Cavendish Maxwell’s Dubai Office Market Report for H1 2025 reveals.

Between January and June, Dubai added 34,000 square metres of new office space, with a further 110,000 sqm expected by the end of 2025. Another 340,000 sqm is forecast for delivery in 2026, pushing the city’s total gross leasable area (GLA) to 9.78 million sqm.

Vidhi Shah, Director and Head of Commercial Valuation at Cavendish Maxwell, said:

“Dubai’s investment landscape continues to flourish, further cementing the emirate’s status as the UAE’s leading economic hub – and a global destination for business. In H1 this year, Dubai attracted more than 500 new FDI projects, securing over AED11 billion in capital inflows, while the DIFC registered more than 1,080 new businesses – a rise of 32% year-on-year.

With strong Government backing and sustained, solid investor confidence, Dubai’s office market continues to deliver an outstanding performance, with yet more records for sales volumes and values. This strong momentum is expected to continue this year and beyond, with a wave of quality new supply further strengthening the market and offering buyers and renters more flexibility.”

Price and rental growth

Average office sales prices rose 22.2% year-on-year to AED1,748 ($476) per square foot, while rents climbed 26.4% to AED166 ($45) per square foot per annum. Compared with H2 2024, sales prices were up 13% and rents by 10%.

Prime business districts saw the strongest gains, with rents in DIFC rising nearly 35% and Downtown Dubai up 33.5%. More mature areas like Bur Dubai, Deira, and Healthcare City saw modest increases of 3.8%, 2.6%, and 2.2% respectively, due to older infrastructure and limited new supply.

Off-plan demand and Top sales locations

Ready offices accounted for almost 85% of sales, but off-plan transactions are gaining momentum. Off-plan sales rose nearly 180% compared to H1 2024 and 90% versus H2 2024, driven by demand for modern, innovation-led, and ESG-aligned projects.

Business Bay led the market with 672 sales in H1, followed by Jumeirah Lakes Towers (534), Motor City (216), Barsha Heights (160), and Dubai Silicon Oasis (77).

Offices between 1,000 and 2,000 sq ft accounted for 48% of all transactions, with spaces under 1,000 sq ft taking 39%. Only 2% of investors opted for units of 5,000 sq ft or more.